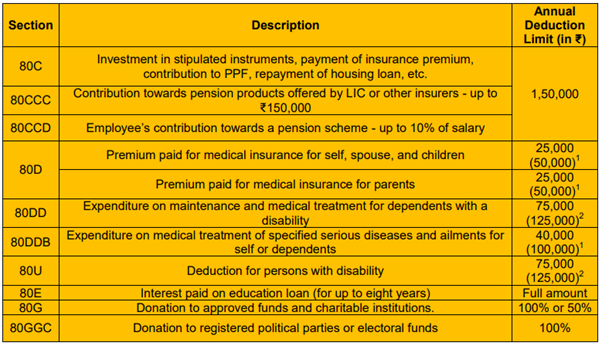

Every Individual who pays Income tax must aware of the Income Tax Sections like Section 80C and other Income tax Sections for saving money.

Income Tax Sections

| Tax Section | Plan Name | Description |

| Section 80 C | Life Insurance Premium LIC | Can avail for Self/Spouse/Children |

| Section 80 C | Public Provident Fund PPF | Can avail for Self/Spouse/Children only upto Rs 1,50,000 in an year |

| Section 80 C | National Savings Certificate NSC | Can avail only for Self |

| Section 80 C | Post Office Time Depoisits | Can avail only for Self, with Minimum lock in period of 5 years |

| Section 80 C | Tax Saving Bonds in Infrastructure Companies | Can avail only for Self |

| Section 80 C | Equity Linked Saving Scheme (ELSS) or Tax Saving Mutual Funds | Can avail only for Self |

| Section 80 C | Unit Linked Insurance Plan ULIP | Can avail only for Self |

| Section 80 C | Principal Repayment on Housing Loan | Houseloan amount in year |

| Section 80 C | Children Education Expenses | Only for two children for Tuition Fees, excluding Donations/Building Fund |

| Section 80 C | Tax Saving Fixed Deposits | Can avail only for Self, with Minimum lock in period of 5 years |

| Section 80 C | Senior Citizen Savings Scheme | Can avail only for Self |

| Section 80 C | Sukanya Samriddhi Account Scheme | Only for Girl child under 15 years |

| Section 80 CCC | Investment made in Annuity Plan of LIC | Can avail for Self/Spouse/Children |

| Section 80 CCD | New Pension Scheme NPS | Can avail only for Self |

| Section 80 CCD(1B) | Additonal Rs.50000 towards NPS | Can avail only for Self |

| Section 80 CCD (1B) | National Pension Scheme | Can avail Self upto Rs 50000 |

| Section 80 D | Mediclaim Insurance Premium | Can avail Self/Spouse/Children, upto Rs 25000, if parents above 60 years then extra Rs 5000 |

| Section 80 E | Education Loan Interest Repayment | Can avail for Self/Spouse/Children |

| Section 80 EE & EEA | Additional Interest paid on housing loan | Can avail for Self |

| Section 80 EEB | Interest Paid on Electric Vehicle Loan | Can avail for Self |

| Section 80 DD | Medical Treatment of Handicapped Dependant | Can avail for dependants |

| Section 80 U | Person Suffering from a permanent physical disability | Can avail for dependants |

| Section 80 G | For Donations | Donations done to NGO’s etc., |

| IT Deduction | For House Rental | Can avail for Self upto Rs 100000, if exceeds must submit Landlords PAN card. |

For more Income Tax sections and Income tax saving options refer to the Income Tax of India Website.