If you are a State bank of India SBI customer having a savings account then you need to maintain a Monthly Average Balance based on the locality you live in, and if you do not maintain the Monthly Average Balance MAB then you will be charged as per below.

SBI Average Monthly Balance

State Bank of India will charge if you have less than below mentioned Monthly Average Balance in your savings account.

SBI Monthly Average Balance

| Location | Average Monthly Balance |

| Metro / Urban | Rs 3000 |

| Semi-Urban Area | Rs 2000 |

| Rural Area | Rs 1000 |

For Metro and Urban Areas You need to have an Average Monthly Balance AMB of Rs 3000 in your Savings account.

For Semi-Urban Areas you need to have AMB of Rs 2000

For Rural Areas Monthly Average Balance is Rs 1000

SBI Minimum Balance Penalty Charges

SBI Penalty for Non-maintenance of Monthly Average Balance:

In Metro and Urban Areas if the balance is less than 50 then Rs 10 + GST will be charged. If 50 – 75% less then Rs 12 + GST and if less than 75% then Rs 15 + GST will be charged.

e.g., If MAB is Rs 2000 then you need to pay Rs 10 + GST for non-maintenance of AMB.

In Semi-Urban areas if less than 50% then Rs 7.50 + GST, if 50 – 75% less then Rs 10 + GST and if less than 75% then Rs 12 + GST

In Rural Areas if less than or equal to 50% then you need to pay Rs 5 + GST, if 50-75% then Rs 7.50 + GST and if less than 75% then Rs 10 + GST.

How Monthly Average Balance is Calculated

The monthly average balance in SBI is calculated as simple average of the closing balance at EOD for the respective month.

A little illustration will make the calculation much easier to understand, let’s say the sum of EOD balances of the March month is Rs 31000, then calculating simple average is 31000/31=1000.

Here 31 is the number of days in March month. So you have maintained a monthly average balance of Rs 1000 for March month.

Based on how much less your monthly average balance from the bank fixed minimum monthly average balance penalty will be charged.

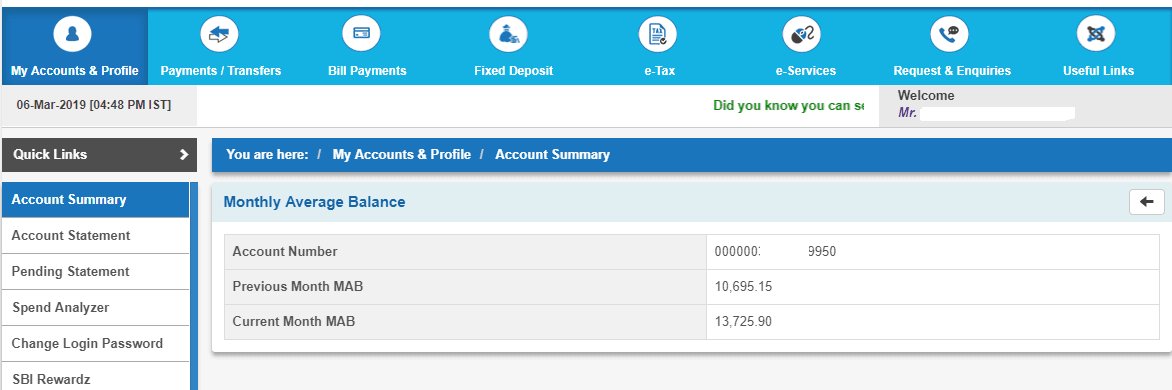

How to check the monthly average balance in sbi net banking:

Login in to onlinesbi.com

Then go to Accounts Summary then Last 10 Transactions then Click on Monthly Average Balancec Tab.

and also in My Account& profile Tab -> Account Summary.

See image below how sbi displays Monthly Average Balance in net banking.

SBI Monthly Average Balance is not applicable to below type of accounts:

- Financial Inclusion accounts including PMJDY accounts.

- No Frill accounts

- Salary Package accounts

- Basic Savings Bank Deposit accounts

- BSBDA- Small Accounts

- Phela Kadam and Pheli Udaan accounts

- Minors upto the age group of 18

- Pensioners all categories

- Recipients of social security welfare benefits.

- Students upto the age of 21 years